What We Do When We’re Asked: “Would You Buy This House?”

5-Minute Read

What We Do When We’re Asked: “Would You Buy This House?”

It’s a question we hear often during inspections: “Would you buy this house?” And honestly, it makes sense. Buying a home is a huge decision, and you’re looking for guidance from someone who has seen hundreds—if not thousands—of homes up close. But as much as we’d love to give you a straightforward answer, that’s not really our role. Here’s what happens when you ask us this big question, why we don’t give a direct answer, and how we help you get to your own conclusion instead.

When You Ask Us, “Would You Buy This House?”

If you’ve asked this question before—or you’re thinking about asking it—you’re not alone. It’s one of the most common questions buyers ask during a home inspection.

What’s our response? Usually, we smile, chuckle, and give a lighthearted answer like, “We’d love to, but we can’t afford it!” or “We already have our hands full with our own house!” It might seem like we’re dodging the question, but there’s a reason behind this approach.

Why We Don’t Give a Yes or No

When it comes to deciding whether to buy a house, no one knows your situation better than you do. Your needs, your budget, and your tolerance for repairs or projects are unique. What’s an ideal home for one buyer might be a non-starter for another.

Our job is to provide you with the information you need to make that decision—not to make it for you. That means we focus on:

- Uncovering issues: We look for everything from the obvious (like leaky pipes) to the less visible (like potential roof damage).

- Providing context: Is this problem common for a home of this age? Does it need immediate attention, or can it wait?

- Answering your questions: If something concerns you, we’ll explain it in clear, straightforward terms.

But whether you should buy the house? That’s not our call, and we intentionally steer clear of influencing your decision.

Everything Can Be Fixed—But at What Cost?

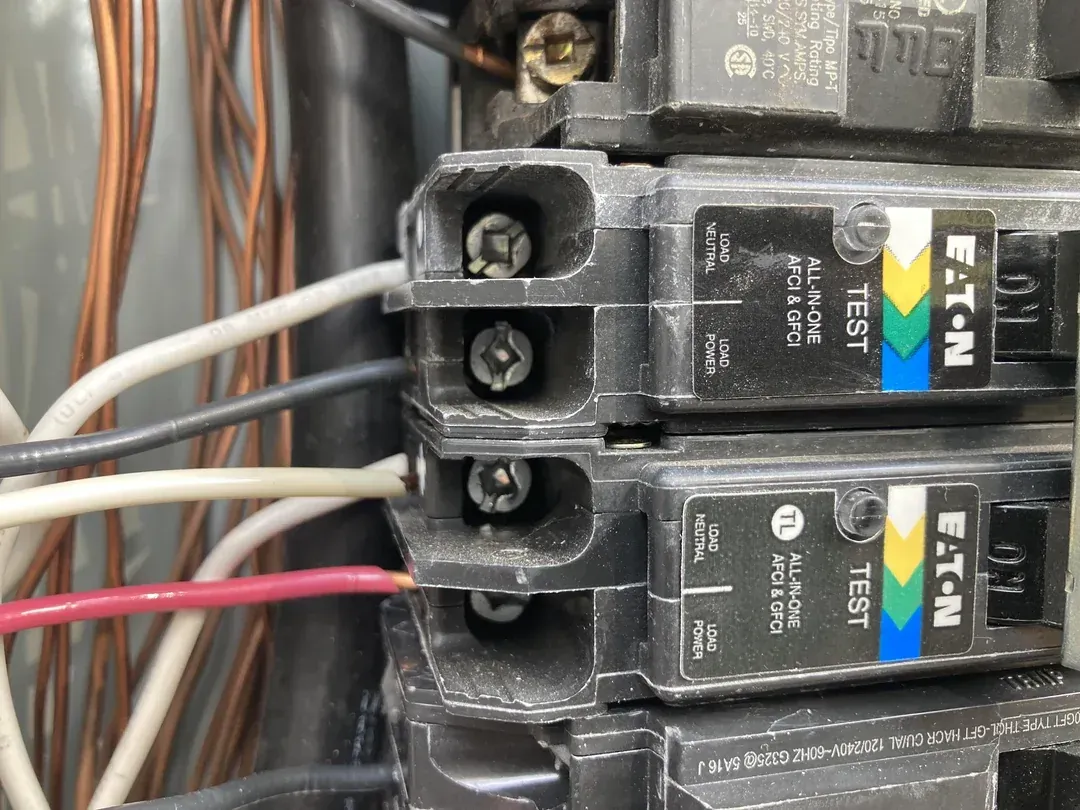

One thing we always emphasize is this: most issues in a home can be fixed. A leaking roof? Replace or repair it. Faulty wiring? Hire a licensed electrician. Outdated plumbing? It can be upgraded.

The real question isn’t whether the house can be repaired—it’s whether the cost and effort of those repairs align with your budget and comfort level. For example:

- If you’re handy: You might see a home with cosmetic or minor repair issues as a fun challenge.

- If you prefer move-in-ready: A home with a long repair list might feel overwhelming.

When you look at it this way, the decision becomes less about the inspector’s opinion and more about what works for you as a buyer.

Flipping the Question Back to You

Instead of asking, “Would you buy this house?” we encourage buyers to dig deeper with questions like:

- “How serious are these issues?”

- “Are these repairs common for a home of this age?”

- “What should I prioritize if I move forward?”

These questions allow us to focus on what we do best—helping you understand the home—while giving you the tools to decide for yourself.

The Role of Your Realtor

Don’t forget: your real estate agent is an incredible resource during this process. They’ve likely seen how similar issues have been addressed in other transactions and can help you navigate negotiations or repair requests. While we focus on the home’s condition, your agent can help you weigh the financial and emotional aspects of the decision.

When We Get Personal (But Not Too Personal)

While we don’t answer the question outright, we’re human too. Sometimes we’ll share a story or an anecdote that relates to your concerns:

- A buyer worried about an aging HVAC system might hear, “We’ve seen units like this last 5-10 more years with good maintenance.”

- If you’re concerned about a cracked driveway, we might say, “That’s common in homes of this age. It’s something you could repair later if it bothers you.”

These insights are meant to guide—not decide.

The Bottom Line

At the end of the day, we’re here to give you the facts about the house, not our opinion about whether you should buy it. That’s your call. And remember: no house is perfect, but every house can be understood.

When you ask us, “Would you buy this house?” don’t be surprised if we smile and say, “If we had the budget!” What matters most is that you walk away from the inspection confident in your decision—whether it’s a yes, a no, or a let’s think about it.

FAQ's

Are there any issues that should be deal-breakers?

That depends on your needs and budget. Some buyers are comfortable taking on major repairs, while others prefer a move-in-ready home.

Can home inspectors tell me how much repairs will cost?

We don’t provide cost estimates, but we recommend getting quotes from contractors to understand potential expenses.

Should I still consider a house if the inspection reveals problems?

Most homes have some issues, especially older ones. The key is understanding the scope of the repairs and whether you’re ready to address them.

Inside the Inspection

Areas We Serve Near Charlotte in NC & SC

CONTACT US

All Rights Reserved | Bannon Home Inspections

Privacy Policy | Proudly listed on inspectopia.com directory

Realtors®, Transaction Coordinators - Download our NEW app!

Inspecting the Monroe, NC & Charlotte, NC areas since 2020. Site by Logan Ridge Creative Studio

Privacy Policy | Proudly listed on inspectopia.com directory

All Rights Reserved | Bannon Home Inspections